Well were here again, and it’s much different from last week… sure some things have happened in the crypto space, but the general momentum has been good.

Most cryptos are up since last week, XRP taking the cake with a 10% upwards trend on price… this is definitely all down to them appearing be winning their long standing battle with the SEC, and bullish investors positioning themselves to capitalize should they eventually win.

I’ve also seen a few rumors surface this week about MEXC and an apparent bankruptcy on the horizon. I’ve not seen any evidence yet to suggest this, but as always I’ll always keep my eye on things and share if there is anything useful.

But enough with the wider crypto stuff for now, we’ve got Defi stuff to cover…

So let’s get to it and find out what’s been happening this week in the Defi space:

Profiteering Pirates

Whilst this is a new mention from me in any form, it’s hard to believe I’ve somehow missed this project, as it’s been around for about 7 months or so at the time of writing.

So what is it?

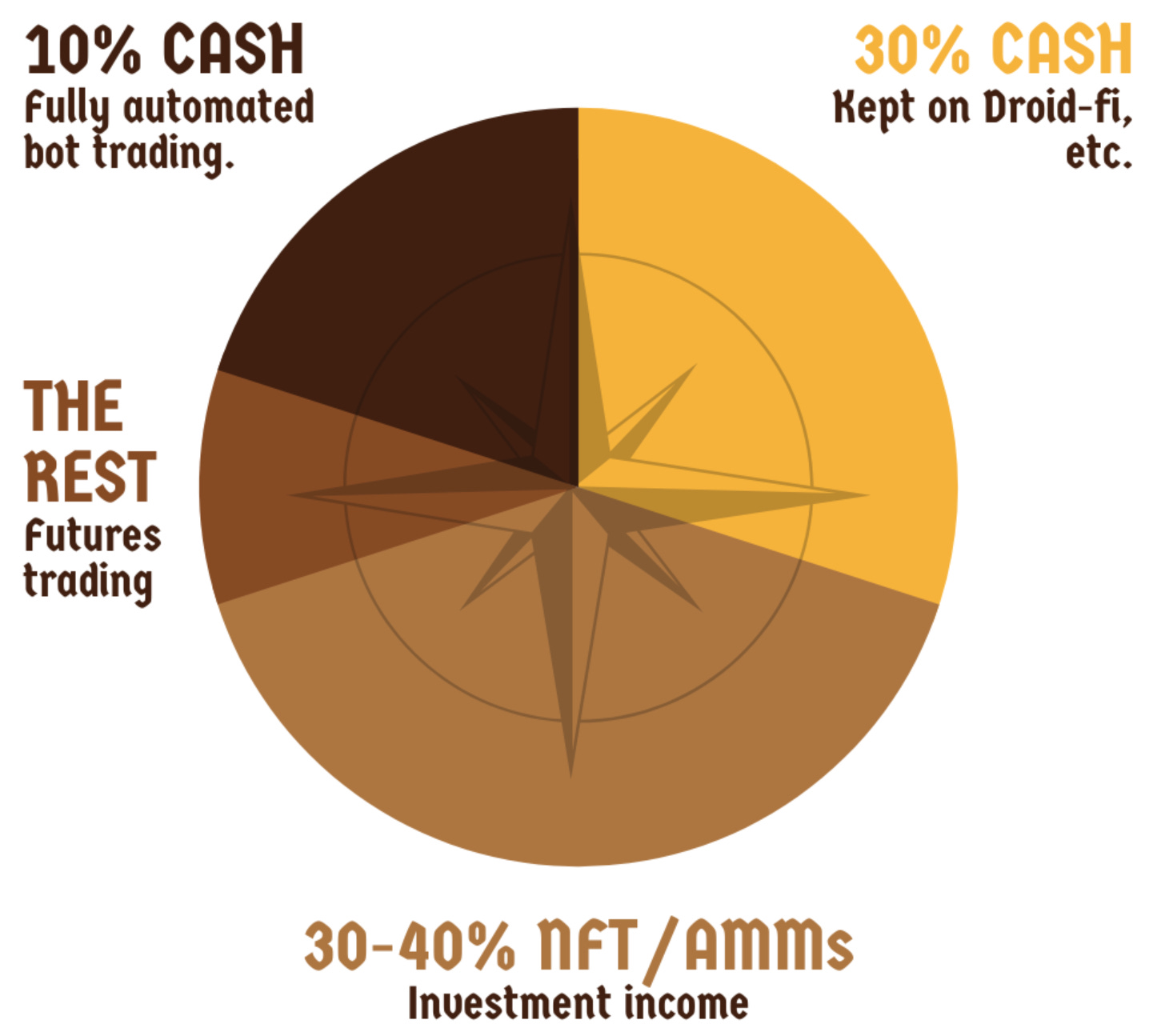

NFT’s, with passive income utility from different revenue generation strategies, some of which include NFT Lending, Derivatives Trading and Liquidity provision.

So what about payouts and such… say no more, here is an excerpt from the whitepaper:

One of the other COOL features of owning one of the NFT’s for the project is that it has copy trading capability built in and with ZERO additional costs. They have developed their own trading bot and this is fully automated. What this means for investors is that you could have an avenue to make additional profit and follow the trades of the team, whilst you sip cocktails on the beach… or something less cringe!

They seem to be a little shy of halfway through their mint, so still plenty of time to get in if for you, I’m tempted to try this one out, given the low entry fee and the copy trade stuff.

The Alchemists

One of my favorite projects at the moment, every time I hear them speak there is a sense of excitement and calm all in one…

So where are we at:

Phase 1 founding fathers mint is completed

Phase 2 mint underway

Newly announced Phase 3 alpha moved into PHASE 2!

Now the last part might have you wondering, so let me spell it out…

B O R R O W I N G A N D L E N D I N G

Backed by Gold, 5kg to be precise for the first run.

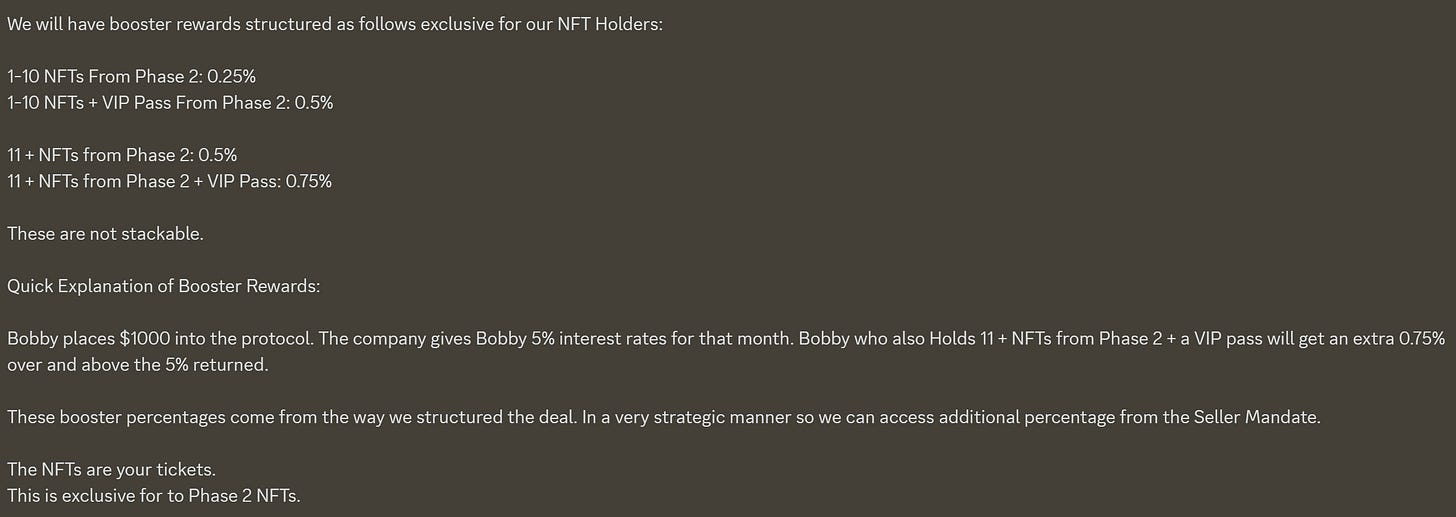

When you mint a phase 2 NFT up until 19th June, you will have an opportunity to then provide your funds (backed by gold) into the lending protocol, to receive between 4% and 8% per month.

The more NFT’s you hold, the more you can earn also with boosted rewards coming as well. Here is an example of that and the boosters:

Borrowing and lending is a hugely popular feature in the crypto space, with borrowers often looking to make more than the interest they pay for borrowing… this makes it super lucrative for lenders.

I’ll be soon taking you all through this new functionality in a dedicated video on my YT channel.

Check out my original video here for details on a very diverse project with some cool utility and community.

Time for a whistle stop now, there’s always something for everyone if you know where to look:

SkyFi - Cryptolids Partnership

Slightly unfortunate news on SkyFi’s relationship with the Cryptolids sub project they were offering NFT’s for. As Cryptolids have been approached by a larger investor and want to proceed with them to enable their project to grow, they need to sever their relationship with SkyFi.

If you purchased an NFT for Cryptolids, then you will be fully refunded.

Steady Passive Play

Some nice rewards are coming out from this project, so thought it was worth sharing, as they clearly have the potential to be quite juicy.

An average of about 4.3% per week is a pretty good return, and could equate to somewhere in the 17%-20% range… If that isn’t good returns, I don’t know what is!

Vulcan Blockchain

Well we all knew that KYC and onboarding for full node holders had begun at a cost… well it is good news for Lite node holders after we found out this week that we are no longer required to stand up Virtual Servers or require any specific hardware to operate, which is all good for extra cost savings.

A new article is due out this week detailing everything you need to know if you have lite nodes. Will keep you posted on what happens as we go!

Wolf Capital

Get ready for another exciting time for Wolf Capital… NFT’s and copy trading.

I’m definitely looking to get one of these, Travis from the team really knows how to trade and has made the community significant profits so far.

NFT’s also have other utility, but go on sale on 6th June this week, so keep an eye out, they will be limited!

Wider macro economic outlook

Hong Kong Crypto

This was a pretty big story this week as the city took a huge step to becoming a Crypto Hub, starting applications for licenses to run trading platforms and crypto exchanges.

We all know that crypto was basically banned back in 2018 across the entire Chinese territory, barring that of institutions and professionals (call that what you will). Well that’s all about to change and given the potential inflow of money from retail investors, this could be the catalyst of the next BULL CYCLE.

Now that statement might seem a little far fetched and if things do go to plan, we could see a dump before a pump. This will be down to how quickly licenses are issued with over 80 companies in China already keen to get a license which launched on the 1st June 2023.

“The fact that an international finance hub like Hong Kong is setting out to create and support a crypto trading environment means a boost of investor confidence in the industry”

Eddie Chou, Blockchain Lecturer and Fintech Consultant

I’m personally all for the bullish news… if we see an influx of new investments coming into crypto, it could be the very catalyst for an exciting second half of 2023… just in time for the Christmas period (when I’m usually poor and require some bullish news to give the kids anything great).

In Summary… Is it time to get bullish again?

If you weren’t already bullish, then maybe it’s about time you slap yourself… if things go as are suspected, then maybe we can all afford a summer holiday after all.

And if you aren’t a wider crypto lover and love the Defi plays, I’ve shared plenty of alpha and opportunities this week, do make sure you do your own research and capitalize where it makes sense for you.

Keep up to date and don’t forget to subscribe so you can follow the story right here, each and every Friday!

Disclaimer

As always nothing talked about here is financial advice. I am an educator and want to share as much information and opportunity as possible to give you as a reader the tools you need to plan ahead.

SPP steady passive play is a rug pull as of 17.06.23

Vincent the trader stole ca. 70% of the money (ca. 12th of June). The Dev wanted to make things right but apparently closed discord 17.06.23. - The first 4 weeks went very well with ca. 10% ROI in the month of May. But the Trader has depth IRL and took the funds.